5 Rising Fintech Startups

| Beauhurst

Category: Uncategorized

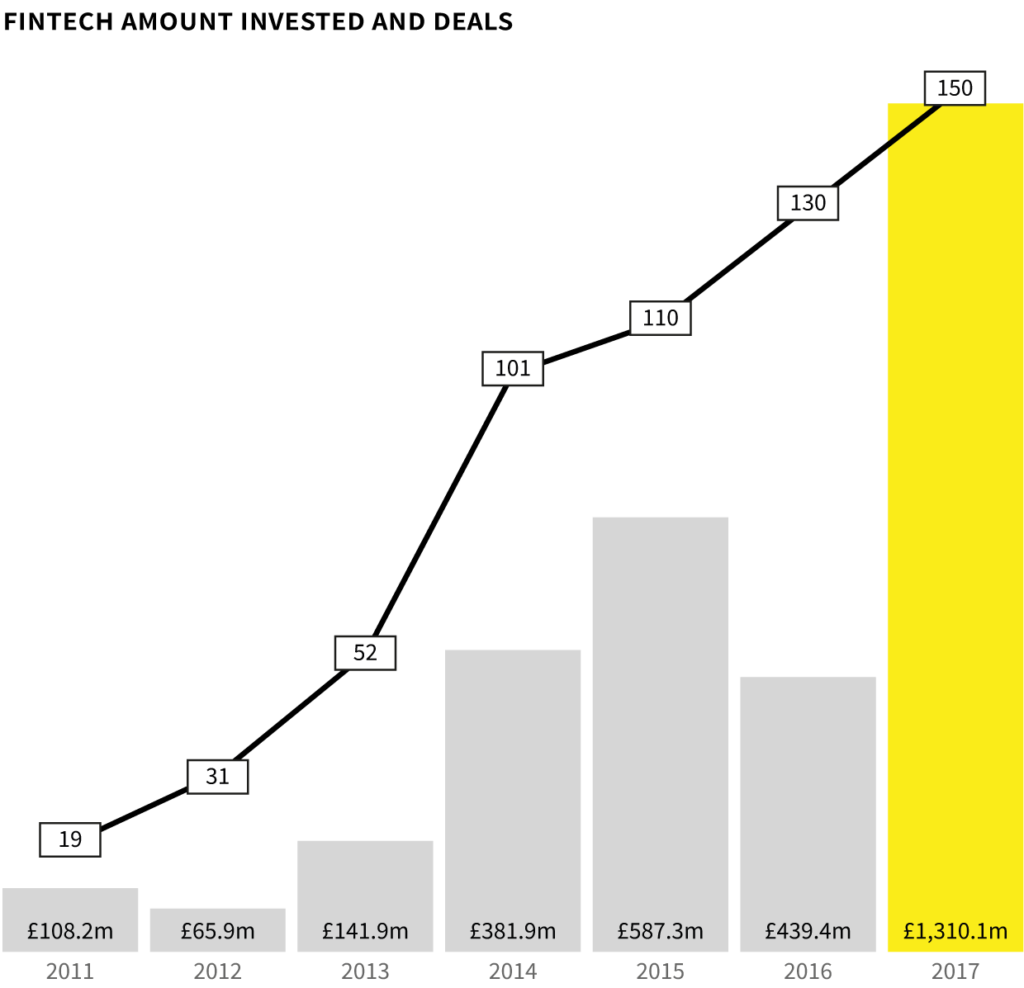

As first outlined in The Deal, 2017 saw an unprecedented surge in investment into fintech companies. Investment in fintech rose by 113% from 2016, making the data behind these companies more pertinent than ever. With this powerful period of growth showing no signs of slowing down, we’ve taken a look at some of the sector’s rising stars. These are the UK’s top five early-stage fintech startups by total amount of cash raised.

10x Banking

Having secured £34million in one of the largest seed-stage rounds seen in the UK, fintech startup company 10x Banking comes in at number one. Created with the aim of helping large banks manage complex data and transactions through a centralised platform, the business was founded by former Barclays CEO Antony Jenkins and is widely touted to be the one of the biggest disruptors to the world of online banking.

Netwealth

Currently valued at £27.4m, Netwealth secured the second largest amount of investment amongst fintech startups with a total of £16.6million raised over the past two years, both rounds funded by a number of angel investors. It provides an online wealth management system that gives customers easy access to a host of financial advisors, and was founded by senior ex-employees of Goldman Sachs and JP Morgan.

Arkera

AI company Arkera comes in at number three. By offering machine learning in the financial sector to help solve problems faced by advisors and salespeople, it has the clear advantage of falling into both the AI and fintech sectors – both of which attracted the highest levels of investment in 2017. With a total of £7.7million investment to its name, as well as its exciting sectoral position, Arkera is one to watch in the future.

Glint Pay

Glint Pay is next on the list, having nearly doubled their initial £3.1million funding in a little over three months. With help from partnerships with Lloyds Banking Group and MasterCard, Glint has developed an app which allows clients to store, spend, exchange and transfer money in various currencies. This in turn can then be used for online payments via the app at the checkout, effectively creating a form of global currency.

Apexx

The final of our five fintech startups is Apexx, which operates as a Payments-as-a-Service company by integrating gateways, shopping carts and Alternative Payment Methods into one system. It also acts as a hub for additional online financial services such as AI-driven fraud management and currency exchange. Since starting-up in April 2016, Apexx have raised £5.35m over three rounds.

A trickle-down effect?

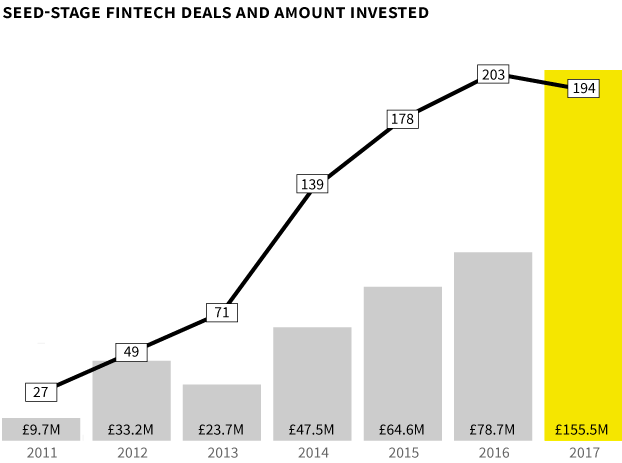

While these investments themselves may not involve significantly high amounts of cash, they do reveal that the shock waves being made at the top levels of fintech investment are being felt right through to the early-stage. Although seed-stage fintech deals didn’t mirror the overall growth in the sector, the amount invested grew significantly from 2016. This could be a sign of the sector maturing, and is promising that larger amounts of capital are available for the right opportunity.

These companies are still small players in a hugely competitive and growing sector, but they could be the fintech stars of the future. We’ll certainly be keeping an eye on them.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.