Equity investment market update: H1 2018

| Beauhurst

Category: Accelerators, Education, Local government, National Government, PE, VC & Alternative Investment, Research & Innovation

The latest data on equity investment trends in the UK. We’ve analysed every publicly-announced equity fundraising in H1 2018, to spot emerging trends and patterns in the market.

See our yearly edition, The Deal, for in-depth analysis and features on key market trends.

Key findings

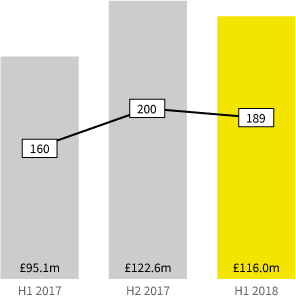

Number of deals

Amount invested

Difference from H2 2017

Difference from H2 2017

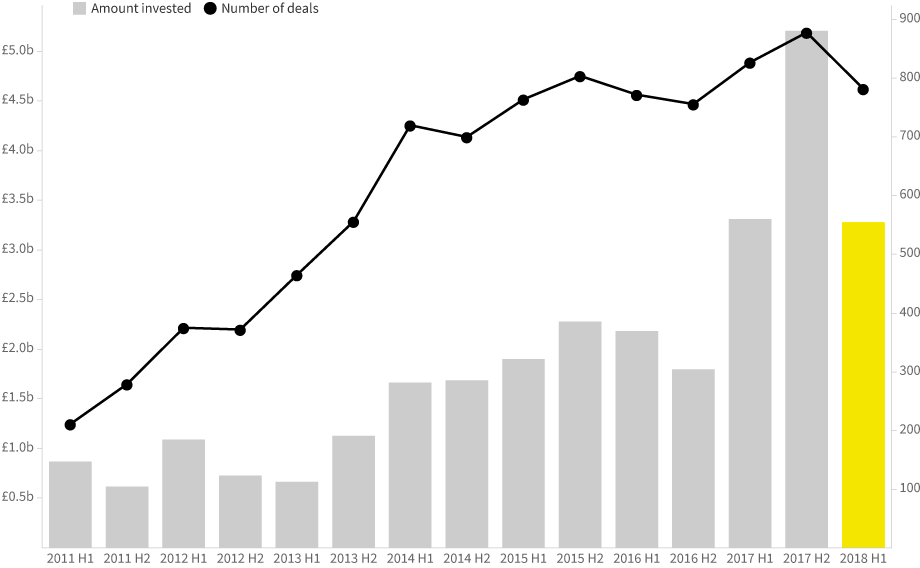

- Deal numbers fell sharply from the previous half.

- The amount invested returned to a more normal level. However, it is still the third highest half on record, and significantly more than pre-2017.

- The half saw fewer megadeals than H1 2018, which contributed significantly to the fall in amount invested.

- The buzz around Blockchain and Virtual Reality companies translated into a good half for these sectors. AdTech saw deal numbers fall for the fourth consecutive half.

deal numbers and amount invested

Investment stages

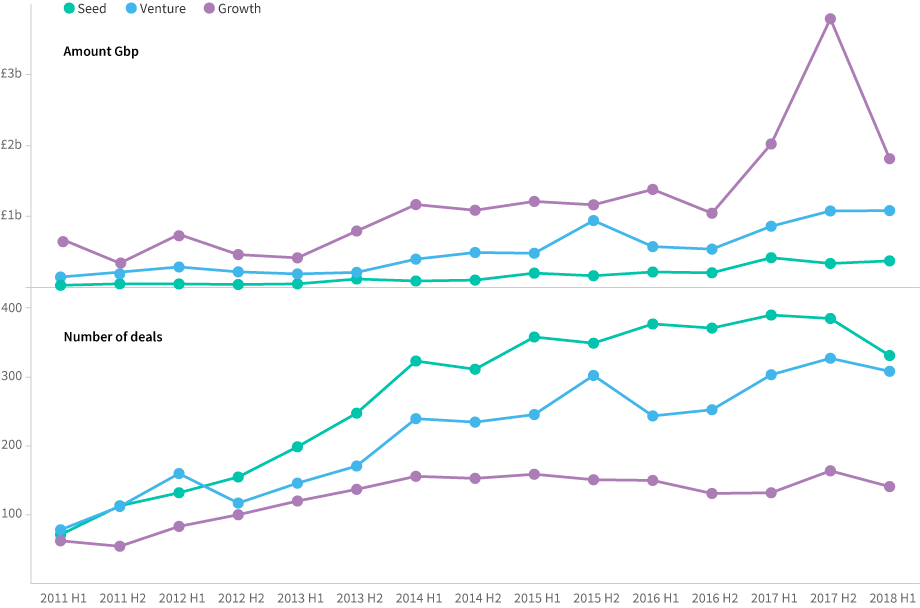

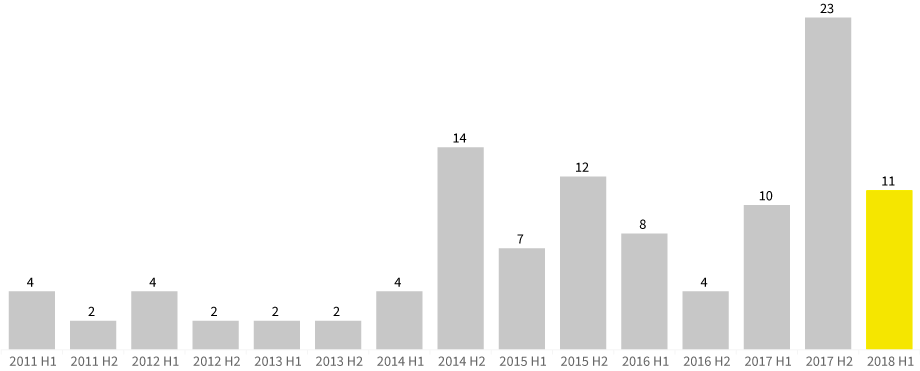

While seed and venture stage deals saw some small growth in the amount invested, this fell sharply at the growth stage, reflecting the overall trend this half. This fall can mostly be attributed to the relative lack of megadeals (those over £50m) compared with the previous half — which corresponds with a decline in foreign investment. Deal numbers fell at every stage of growth.

deal numbers and amount invested by company stage

number of megadeals (£50m+)

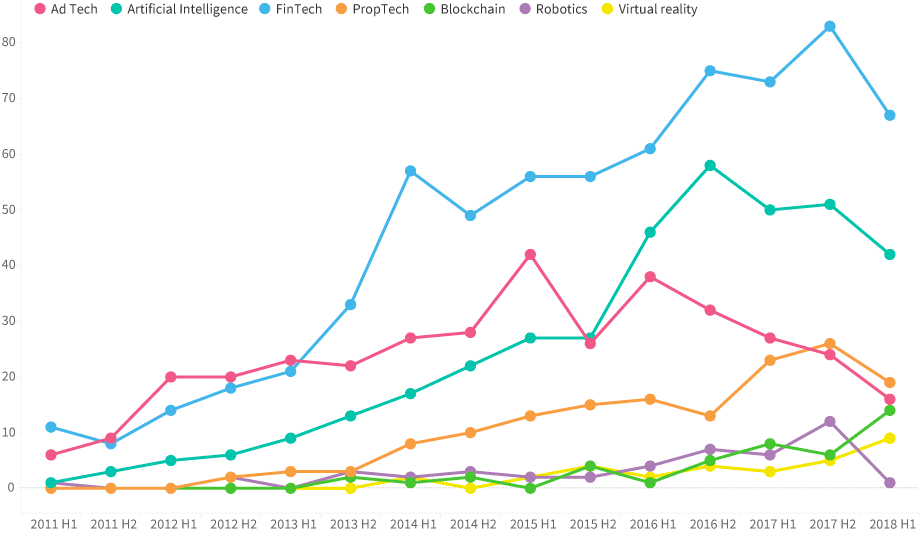

Sector focus

This half saw deal numbers fall across almost all of the UK’s most popular verticals. The outlook appears particularly bad for AdTech, which has seen four continuous halves of declining deal numbers. Has the sector lost its shine for the UK’s investors? Investments into Robotics companies have also taken a nosedive, with only one made in the first half of this year.

But not all sectors are faring so badly — both Blockchain and and Virtual Reality companies saw deal numbers go up. While these sectors have been creating a lot of buzz over the last few years, it is only now that we are seeing this translating into significant growth in investment.

Crowdfunding in H1 2018

British crowdfunders invested £116m over the first half of 2018, over 189 deals. This total round amount (including participations from other investor types) of these deals was £139.6m. *

major crowdfunding platforms, deals

Crowdfunding investments

Crowdcube

£48.5m

81 deals

Seedrs

£31.3m

80 deals

SyndicateRoom

£19.4m

25 deals

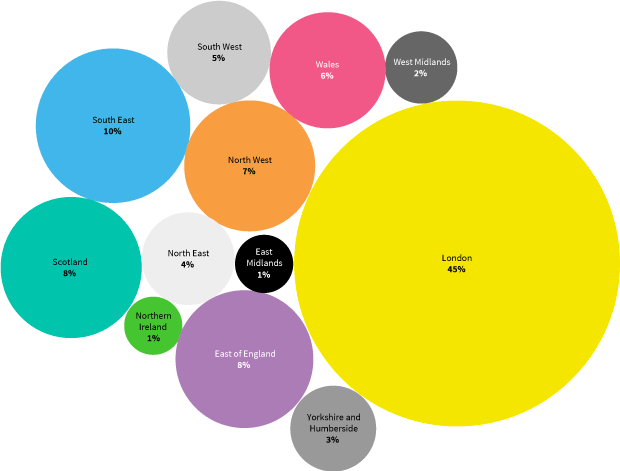

Regional distribution

As always, London dominated the picture, taking 45% of deals in H1 2018. In comparison, this figure was 35% in H1 2011.

regional share of h1 2018 deals

*Addendum – The crowdfunding figures in this article have been updated to reflect new information and to correct a mistake in the calculation of some totals

Have you seen our full year report?

The Deal is our free, detailed analysis of every equity fundraising in 2017. We look at the stories behind the deals, and examine which companies, investors and sectors are making waves.