High-growth fashion: data on a risky business

| Beauhurst

Category: Uncategorized

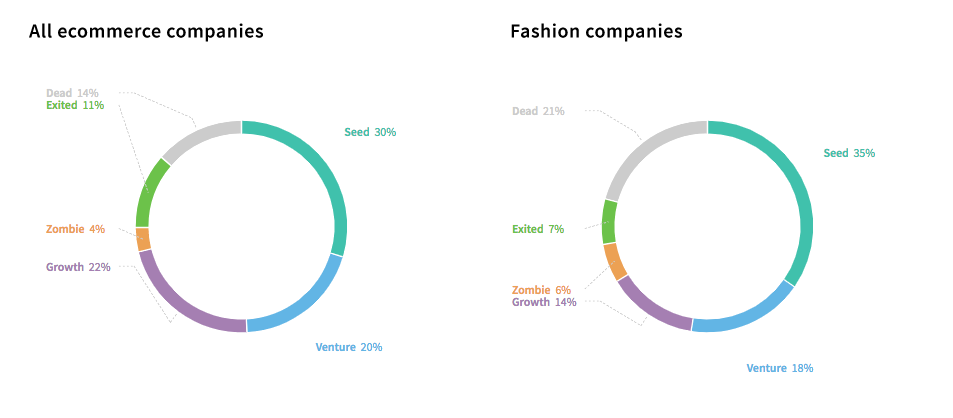

Fashion is a fast-paced industry, but it’s also a risky one: we’ve discovered that amongst high-growth companies in the sector, death is three times as common as a successful exit. That’s a considerably worse outcome than we see for most sectors, including tech and leisure. So what else do we know about the retailers venturing into the space?

We see the size of the blocks decreasing from left to right, as would be expected: companies founded in 2015 and 2016 have had very little time in which to achieve high valuations. An outlier is StylistPick, which raised £11.9m over two rounds during 2011-12. The company offered a fashion recommendation website, on which users could take a quiz to establish their preferred styles, and then be sent tailored suggestions for clothes. Investors included Accel Partners, Index Ventures, and Eight Road Ventures, and Grant Thornton Services held a total stake of 22.92%.

StylistPick was acquired by Hallett Retail in 2013, though it’s unclear whether this was a successful end for the business or not (it might have been acquired for an amount that profited its shareholders, or the acquisition might have been distressed: either way, the company is now dissolved).

And as above, fashion companies certainly carry their share of risk: in the past, 50% more have died than in the ecommerce sector as a whole, with one in five fashion companies failing during the time period, and fewer have gone on to exit successfully.

Within the extant firms, personalisation seems to be a popular niche right now. Similarly to StylistPick, Thread operates a fashion stylist service aimed at men that employs machine learning, and Smithfield Case (acquired in 2013) went one step further, sending men selections of clothes based on their tastes. Dappad does the same. ASAP54 allows users to take pictures of clothes they like and upload them to find similar items, much like Cortexica. With the steady rise of artificial intelligence, it’s possible that this kind of tailored service will soon become the norm.

When it comes to location, what’s immediately striking is the sheer proportion of high-growth fashion companies based in the capital. Certainly, more fashion companies overall are based in London (18%), but more than two thirds (67%) of high-growth fashion companies have chosen the city for their home.

There is much speculation about what causes so many scaling companies to bed down in London, but it’s clear that fashion companies have not escaped the trend. That said, with private equity and venture capital money contributing to the majority (60%) of fashion investment deals, and also disproportionately located in London, it is perhaps unsurprising that so many have opted for the capital.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.