2017 sees record investment in precision medicine

| Beauhurst

Category: Uncategorized

Precision medicine is a relatively new field of study, but has already made the transition from academic research to the occupation of high-growth companies.

The discipline involves customising healthcare to suit small groups of patients, or eventually individual patients, based on a variety of factors including patients’ panomic profiles. A panomic profile is one that looks at genes, proteins, cell processes, and other biological markers at the molecular level. Each of these may be highly unique. One of the many applications for this kind of analysis is precision oncology – popularised as “personalised cancer treatment“.

There are numerous advantages: precision medicine might prevent unnecessary drug interactions, prevent overprescribing, and reduce costs associated with both. But how is the technology progressing in the UK, and which companies are leading the charge?

Looking only at Britain, the short answer is that precision medicine is being funded more extensively than any time in history. The graph below shows both the number of deals into the sector and the amount invested; both have hit an all-time high this year, despite more than three months of deals yet to come.

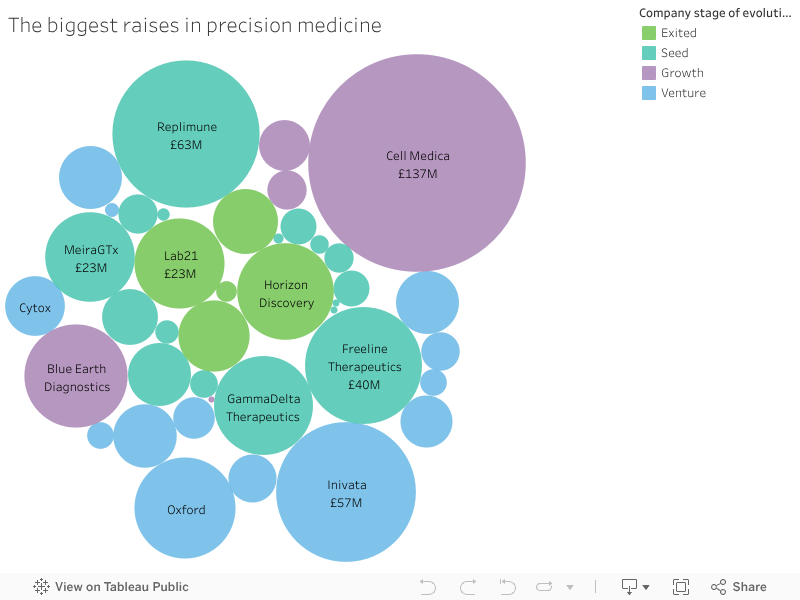

In terms of equity finance raised, Cell Medica heads the pack with £137m in investment from Invesco Perpetual, Touchstone Innovations, and Woodford Investment Management. The first two of these are patient capital firms, which we see particularly active in the life sciences and pharmaceuticals space – not least because of the long research and development periods characteristic of startups in these sectors. Indeed, measured by value of investments, Touchstone Innovations and Invesco Perpetual are the highest overall contributors to precision medicine, having been involved in deals worth £162m and £137m (down to Cell Medica alone) respectively.

(We showed in our Innovate UK report that companies which secured both grant and equity finance tended to have higher valuations.) Now, the company’s work spans immunotherapeutics and oncology, and its technology can identify special kinds of white blood cells and accelerate their growth.

Replimune has raised less than half of Cell Medica’s finance, but comes in second on our list (despite being only two years old). Last week the firm raised $55m (£41m) from a wide variety of investors; part of which was follow-on funding (from Atlas Venture, Forbion Capital Partners, and Omega Funds).

Replimune also works in oncology, but unlike Cell Medica it does not try to supercharge the body’s existing defences. Instead, it uses oncolytic viruses (viruses that preferentially destroy cancer cells) to attack the cancer, and at the same time stimulate an autoimmune response from the patient’s body – this element is what involves Replimune in precision medicine.

Inivata follows Replimune closely, having raised a total of £56.5m, and its offering is also focused on cancer. Inivata is not in the business of treatment, however, but diagnosis. Its uses a liquid biopsy to detect cancer growth, which is minimally invasive compared to traditional tumour biopsies, and has the advantage of allowing continuous monitoring during the course of a patient’s treatment, as well as detecting mutations and metastasizing.

There are more than 40 other high-growth UK companies operating within precision medicine, and it would be impossible to profile them all. Below is a diagram showing all of these firms by amount raised in equity – hover over each for more detail.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.