Tuning in to high-growth companies: innovating in the music industry

| Beauhurst

Category: Uncategorized

Music is integral to most of our lives, and never before have we had so much choice when it comes to listening – whether through an app or at a concert. But the options don’t stop there. Below, we take a look at some of the most innovative and disruptive startups, scaleups, and high-growth companies in the music sphere.

Excluding individual venues and artists, Beauhurst tracks 120 companies in the sector. Since 2004, they’ve raised a combined total of £300m, although, as we’ve seen across the board, the industry has seen fundraisings decline over the last two years:

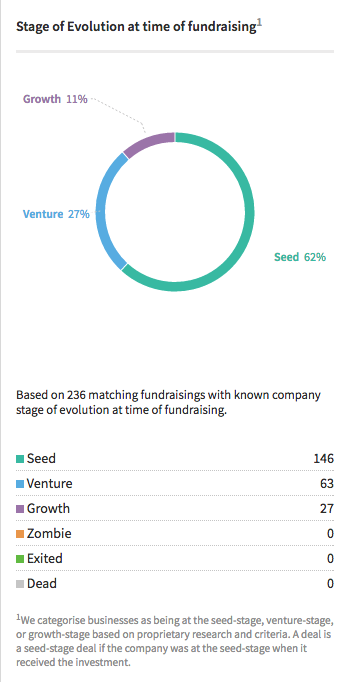

Of these deals, the vast majority went unannounced to the press or public. One reason for this is that many of the companies in this collection are very young (and thus less likely tohave press releases picked up) – with almost two thirds of the deals being secured by firms which were in their seed stage at the time, and only 11% of the fundraisings going into growth-stage companies.

Of all companies in the sector, 12% have died, and at least one is classed as a zombie: this means that the company’s website and/or social media presence shows prolonged neglect.

Six companies in the space, however, have exited: Blinkbox Music, 7digital, Semetric, MAMA Group, Crowdsurge, and PingTune.

Blinkbox, also known as we7, was a cloud-based music streaming service designed to allow users to create their own radio stations online. It was acquired by Tesco in 2014 for £10.8m, and has since passed to TalkTalk, where it has rebranded as TalkTalk TV.

Similarly, PingTune – a music messaging app – was bought out by Eros International, and has become part of its ErosNow platform.

7digital and Semetric continue to function after their acquisitions by UBC Media and Applerespectively. 7digital develops streaming software, and Semetric (also trading as Musicmetric) tracks discussion of music online to provide behavioural insights to the entertainment industry. Crowdsurge, a ticketing site, was acquired by Songkick, and North East music venue firm MAMA Group was acquired by US entertainment firm LiveNation.

The headline act in the sector, however, is unquestionably Shazam. Shazam has developed a mobile music discovery app that also allows consumers to share content; it has recently partnered with Songkick to extend its services. The two firms have raised more than £128m between them (Shazam on £90.1m and Songkick on £38.1m), and are followed by ROLI (£31.3m) and MusicQubed (£26.7m).

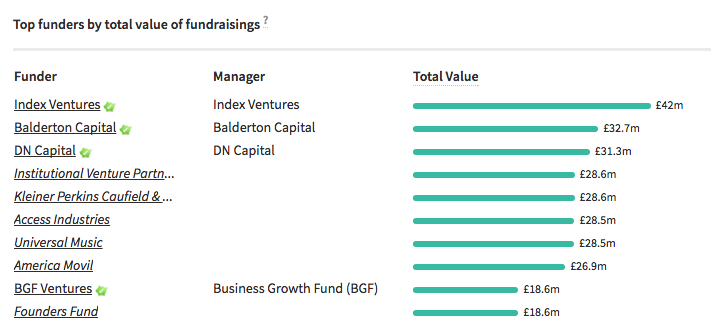

When it comes to the money behind the music, institutional investors dominate the scene, with several non-UK players making an appearance:

As for what the young companies in this sector do, the majority of develop app or software-based products, but several also produce physical goods. Below is a small sample of the products high-growth music companies offer.

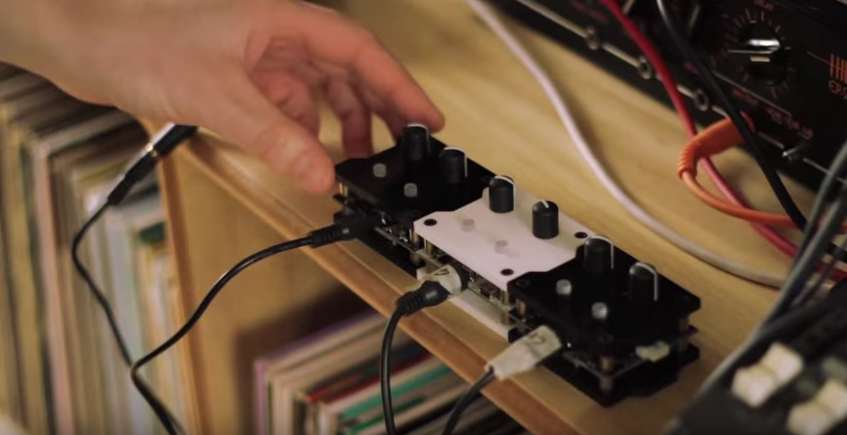

Patchblocks, also trading as MindFlood, develops modular audio synthesisers (pictured above) that can be used as drum-machines, guitar-pedals, and more. The company has raised £325k over two fundraisings, and is headed up by Sebastian Heinz, whose experience is as a software developer.

The most eye-catching gadget on offer is created by ROLI, which offers “BLOCKS” (left). Touching them determines the sound produced – from tone to texture, duration, intensity and more. As users become more experienced, they can add more blocks to their sound system. The sound is controlled via an app, and the tech has already garnered praise from artists including Grimes and Steve Aoki.

ROLI has raised £31.3m over five fundraisings, as well as securing 8 separate grants from Innovate UK, the UK government’s funding arm. It’s led by Roland Lamb, who amongst other things is a teaching fellow at Harvard.

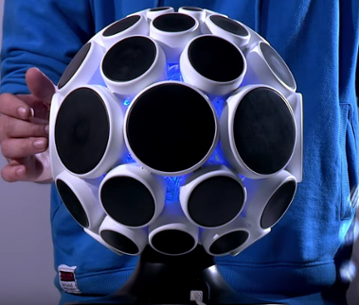

Another product to watch is the eponymous musical ball (below) produced by AlphaSphere. It features 48 pressure-sensitive, tactile pads designed to respond to the lightest touch. The creation can also trigger pre-created tracks or samples, managed through custom software as with BLOCKS.

AlphaSphere has received £118k over two fundraisings, and was founded by Adam Place, who received the Telegraph’s award for Most Disruptive Entrepreneur in 2014.

Skoog develops a similar, albeit less sophisticated, product aimed at introducing children to music education. The ergonomic, cube-shaped instrument is designed specifically to assist children with various disabilities, and the company (originally spun out from the University of Edinburgh) has received £805k over four fundraisings.

A final mention goes to GrooveME, a hologram company. GrooveME records performances of musicians and converts them to holographic videos, which one of its investors claims are almost indistinguishable from real-life performances. Indeed, its investors include Bob Geldof, who owns 3.77% of the company, and Sarah Willingham of Dragon’s Den fame.

As above, the UK music industry is not currently in the ascendant as a whole. It would be a mistake, however, to underestimate its potential. The proportion of early-stage investments into the industry alone is enough to encourage confidence – and if the companies discussed above continue to produce groundbreaking technology, it’s certainly possible that the sector could remain the UK’s forte.