Equity investment market update: Q1 2018

| Beauhurst

Category: Uncategorized

The latest data on equity investment trends in the UK. We’ve analysed every publicly-announced equity fundraising in Q1 2018, to spot emerging trends and patterns in the market.

See our yearly edition, The Deal, for in-depth analysis and features on key market trends

Key findings

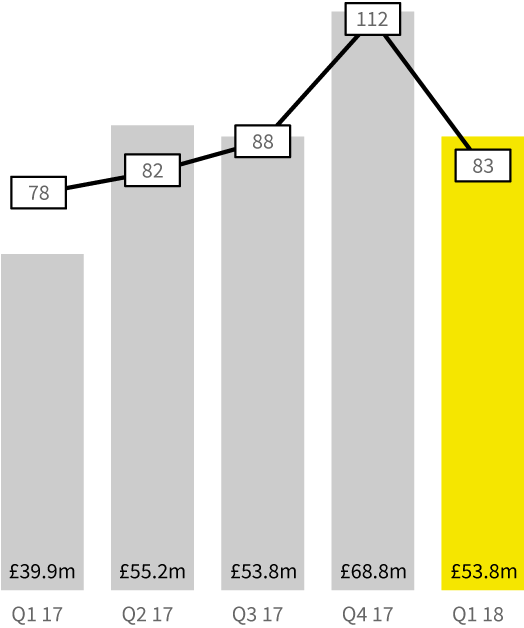

Number of deals

Amount invested

Difference from Q4 2017

Difference from Q4 2017

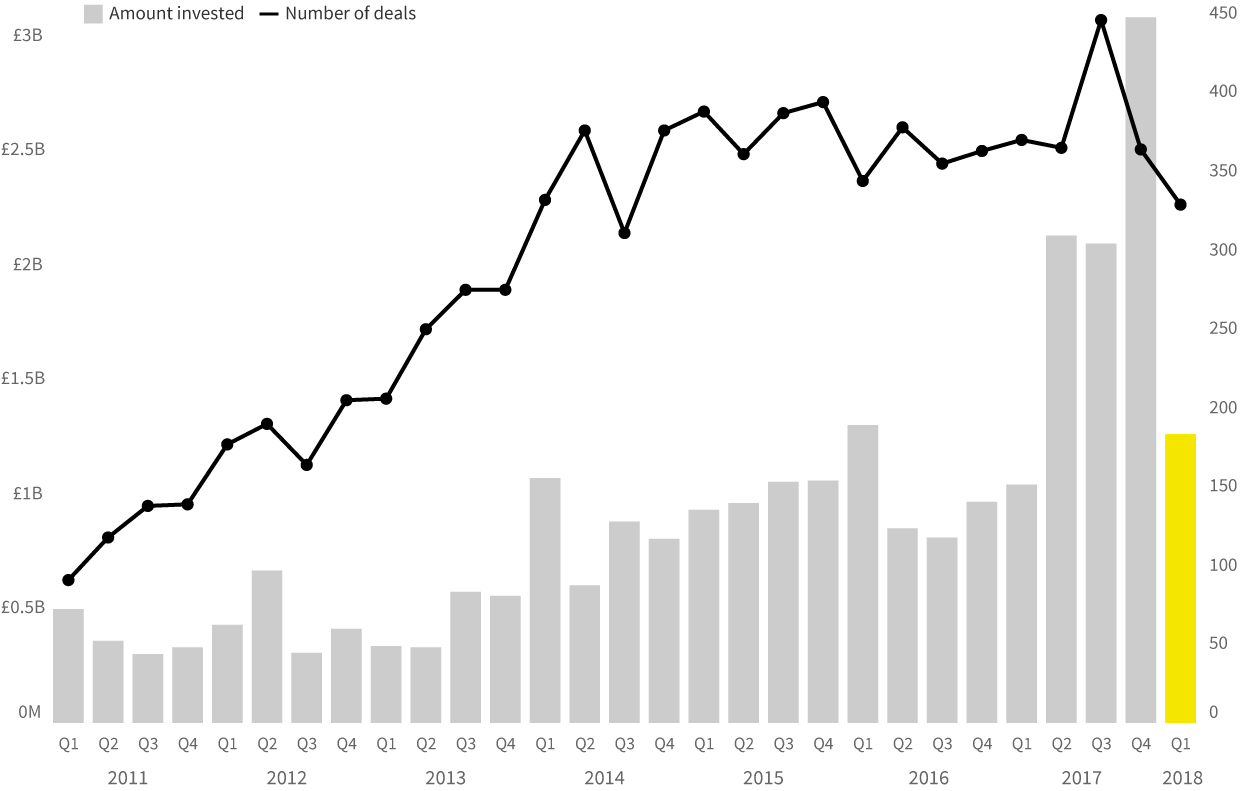

- Deal numbers fell to their lowest since Q3 2014.

- The amount invested returned to a more normal level. However, it was still more than Q1 2017, which preceded three bumper quarters.

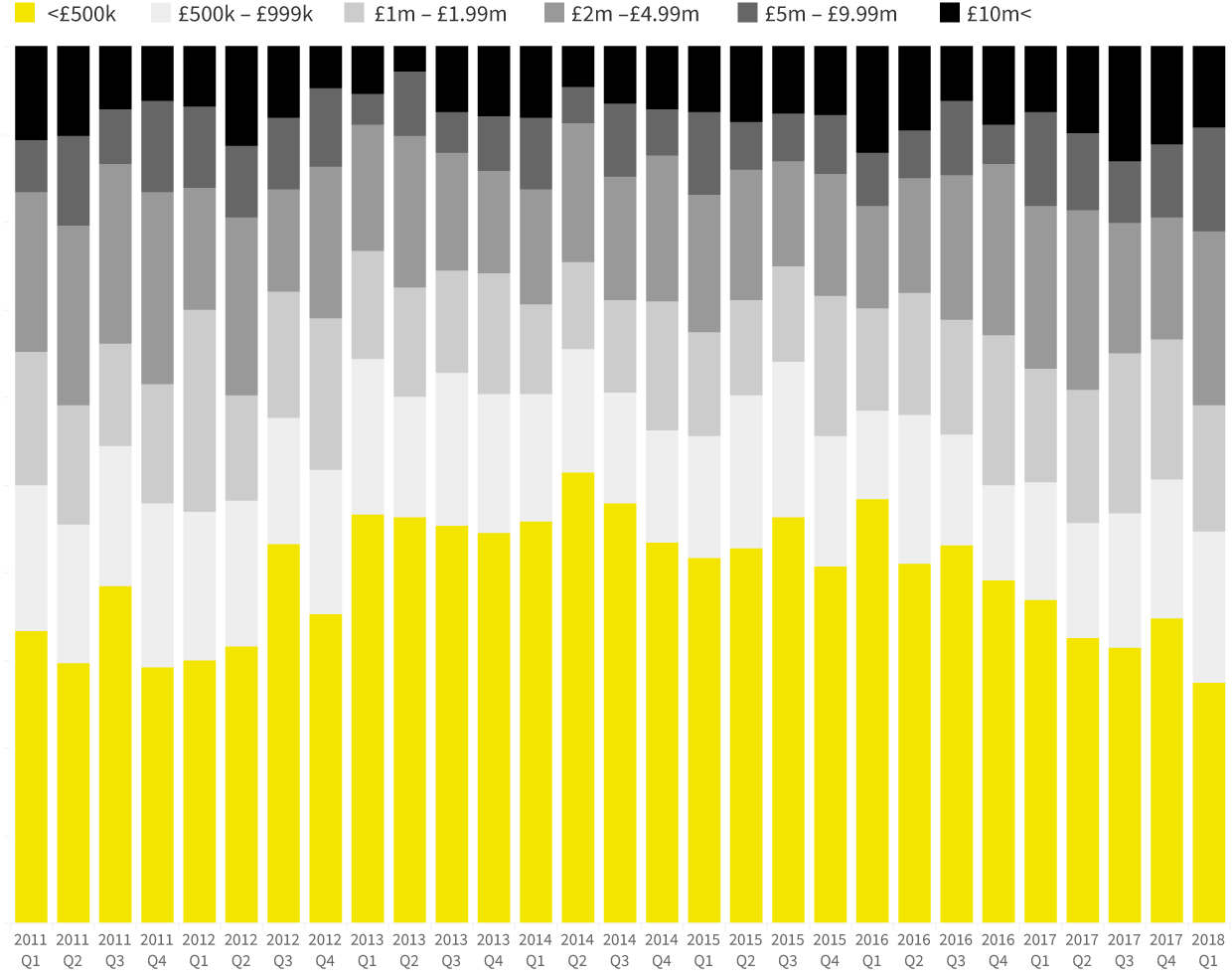

- The quarter saw the lowest ever percentage of deals under £500k.

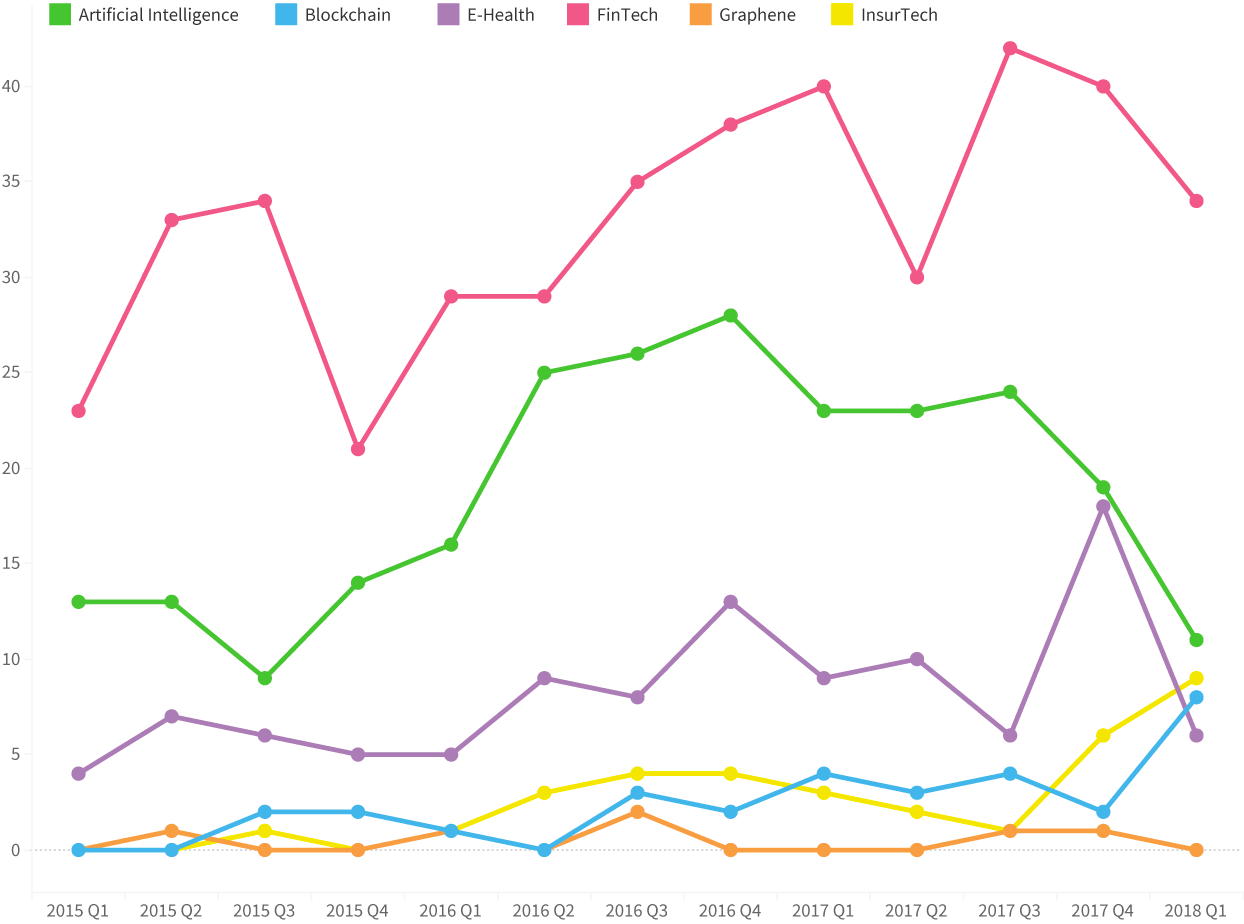

- Fintech verticals Blockchain and InsurTech performed well, but AI deal numbers continued to fall — perhaps signifying the end of a bubble?

quarterly deal numbers and amount invested

Investment stages

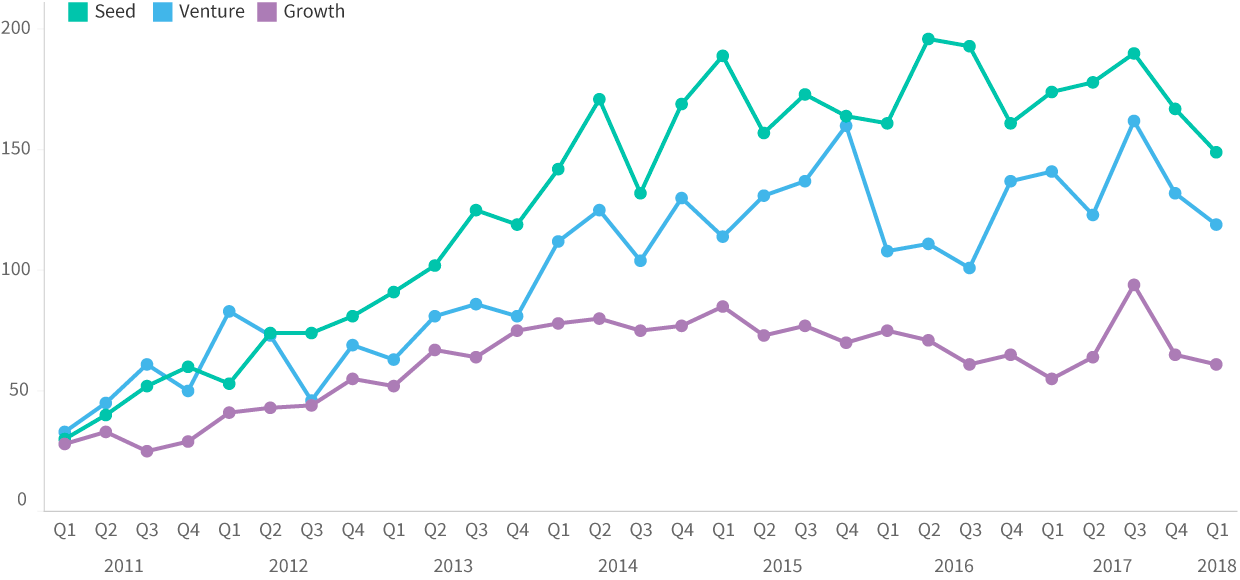

As we noted in our yearly edition of The Deal, the current trend points towards a fewer number of deals at higher values. This was especially evident this quarter, with the lowest ever number of deals below £500k. Deal numbers fell at every stage of growth.

deal numbers by company stage

percent share of deals by investment bracket

Sector focus

This quarter saw strong growth in blockchain and InsurTech deal numbers. Both of these verticals are closely related to fintech, which despite a fall in deal numbers from last quarter, continues to draw in a significant number of investments. We suspect these two sectors might be 2018’s most exciting areas to keep an eye on.

The outlook doesn’t seem quite so positive for artificial intelligence in 2018, which, despite it’s huge profile, has gradually seen investment fall to 2015 levels. Might we be nearing the end of an AI bubble?

Deal numbers, selected sectors

Crowdfunding in Q1 2018

Last quarter, British crowdfunders invested £53.8m over 83 deals. This total round amount (including participations from other investor types) of these deals was £57.7m.

crowdfunding platforms, deals

Crowdfunding investments

Crowdcube

£21.2m

35 deals

SyndicateRoom

£8.7m

13 deals

Seedrs

£13.7m

32 deals

VentureFounders

£6.8m

3 deals

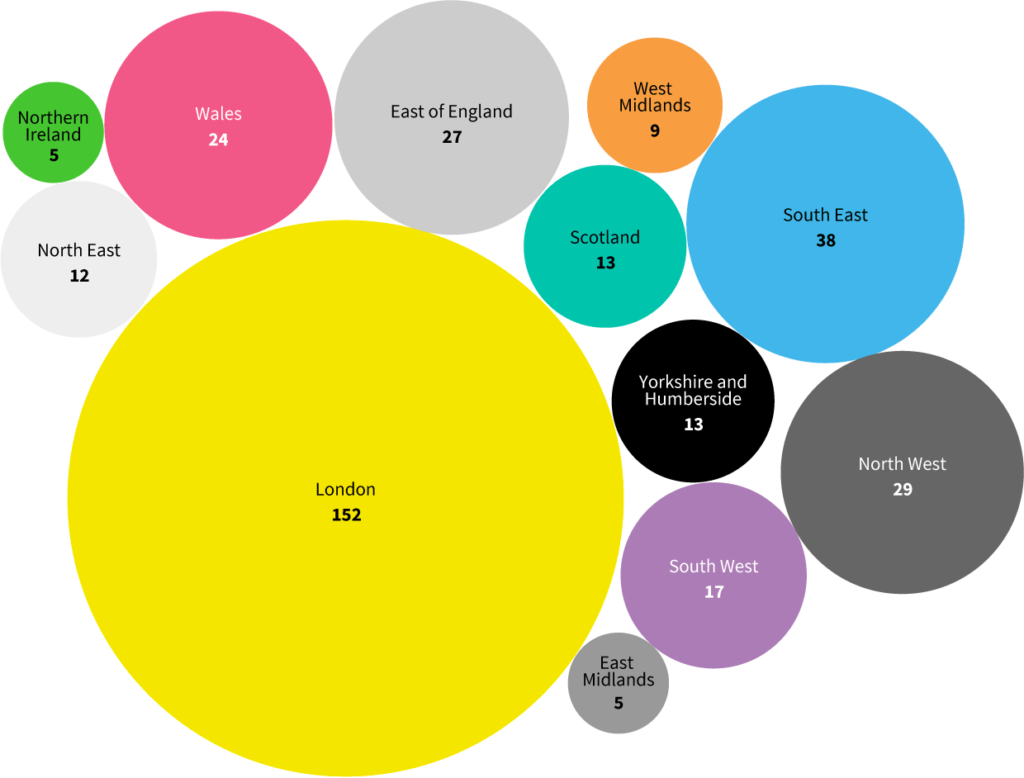

Regional distribution

As always, London dominated the picture, taking 44% of deals in Q1 2018. In comparison, this figure was 35% in Q1 2011.

Have you seen our full year report?

The Deal is our free, detailed analysis of every equity fundraising in 2017. We look at the stories behind the deals, and examine which companies, investors and sectors are making waves.