Local Enterprise Partnerships – the UK’s leading LEPs

| Beauhurst

Category: Uncategorized

The Beauhurst platform is a vital tool in the arsenal of any Local Enterprise Partnership (LEP). Our software allows LEPs to analyse their economies, identifying key strengths, weaknesses and trends, and providing the foundation for a more intelligent Strategic Economic Plan.

LEPs themselves play an important part in promoting their respective areas to outside investors and entrepreneurs looking for the best place to start their new business. Which LEPs are currently the most attractive to investors? London predictably takes the top spot in each category by quite a margin; for the purposes of this analysis, we have excluded the capital from our statistics, and will instead focus on the regions.

Important note: these figures shouldn’t be taken as a measure of how effective the given LEP has been. More investment activity in one LEP over another will not be solely due to the expertise of the LEPs themselves. A variety of factors play into these figures, such as size, or the presence of universities.

Top 10 LEPs by equity finance investment (2017)*

*Excluding London.

Top 10 LEPs by equity finance deal numbers (2017)*

*Excluding London.

Numerous reports have highlighted the economic hegemony of the UK’s golden triangle. This is borne out in our analyses of the UK’s top LEPs, with the top three spots going to London, Greater Cambridge & Greater Peterborough, and Oxfordshire. However, why is there such a large discrepancy between Cambridge and Oxford? A large part of this comes down to one deal: £675m, secured by Peterborough’s insurance scaleup BGL (who own comparethemarket.com). If you take this anomalous deal out of the stats then the figures are much more even, with the Cambridge LEP taking in around £303m.

In fact, once we account for this deal, Greater Manchester LEP comes out on top in terms of equity finance raised in their area.

In terms of deal numbers the picture is similar, with Cambridge and Oxford coming out on top, closely followed by South East LEP (encompassing the coastal counties to the north-east and southeast of London). Greater Manchester also performs well.

LEPs and scaleups

Raising lots of equity finance is all well and good, but how do you measure whether this translates into actual business growth? One way we could do this is to look at how many scaleups are located in each LEP. It’s a crude measure, as locating scaleups requires companies to file fairly full accounts, which they will only do when generating a certain amount of turnover. However, it’s still a good indicator of significant business growth.

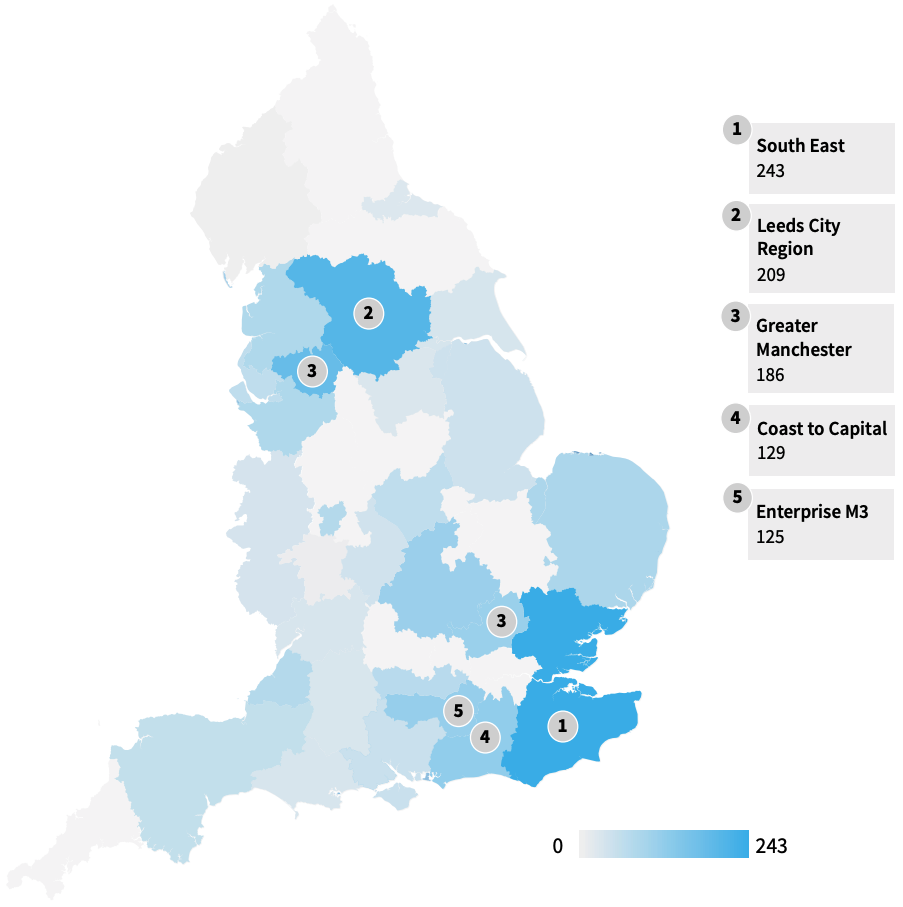

Top 10 LEPs by no. scaleup HQs (as of November 2018)*

*Based on currently active scaleups. Excluding London.

As is clear, the picture for scaleups and LEPs is a slightly different than for investment. LEPs in the north are much more prominent. However, it’s also important to remember that these stats exclude London, which is home to over a 1,000 currently active scaleups. The next most scaleup rich LEP is the South East, immediately adjacent to London. You can read more about the latest data on scaleups in our second collaboration with The ScaleUp Institute, The Scaleup Index 2018.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.