Venture Capital Investors: Who are they?

| Beauhurst

Category: Uncategorized

Funds are an integral part of the entrepreneurial ecosystem; they supply the financial fuel for ambitious companies’ growth. Equity investment has become increasingly critical within this landscape. Equity refers to investment made in return for shares in a private company. The potential growth of a company and its valuation after this investment can amplify the value of these shares. Extracting the value of these shares, so as to make a return on the initial investment, can be achieved either through selling the shares, selling the company via acquisition or floating the shares on a stock market, via an initial public offering.

The UK is host to many different types of equity investors; this three-part blog series will look at the different types of investors, their investments and the sectoral and geographical preferences. This blog will introduce the top seven types of investors in the UK, as shown in our annual report, The Deal 2018, and how their investment activity has changed over the last five years. This diversity contributes to the success of the UK’s high growth scene, as different companies have varying requirements from their investors. A company may need a small, quick injection of cash, or a longer, more patient investment. They could prefer a hands-off approach from their shareholders, or be looking for more mentorship and consultation about their growth. This variety of investor types can meet the diverse requirements of the startup and high-growth companies based in the UK.

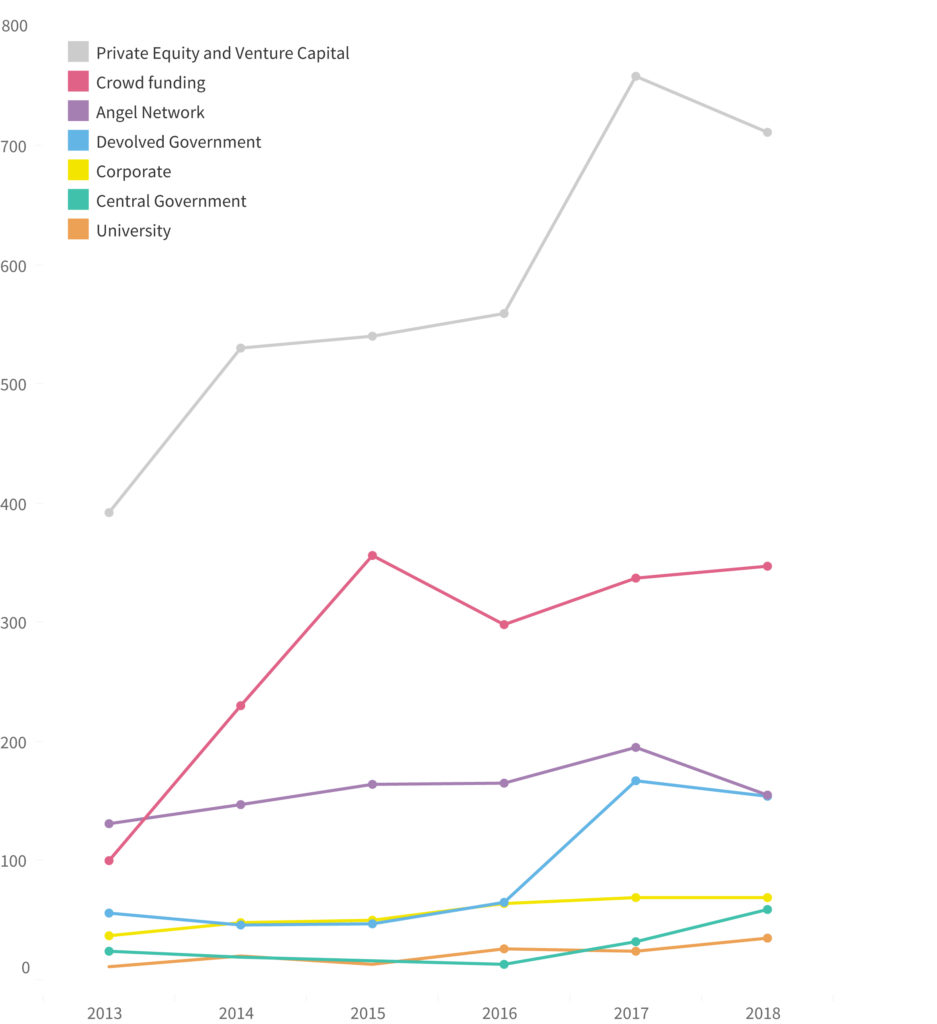

Number of deals made by different investor types

In 2018, 1,541 publicly announced equity investments were made into the UK’s fastest growing private companies. Private equity and venture capital firms make significantly more investment deals than any other category of investor, and have done since 2013. In 2018, these types of investors backed 711 announced equity deals, more than double that of the second most frequent investor type, crowdfunding.

Crowdfunding investment has shown stratospheric growth since 2011, when only 8 deals were backed by crowdfunding sites. In 2018, they were the second most common type of investor into British high growth business, backing 347 deals and involved in 22% of all equity investments. The rise of crowdfunding has been facilitated by the internet; any individual can now log on and support a company’s funding round. However, while these collective investment platforms make numerous investments, the rounds tend to be smaller on average, as we will explore in the second blog of this series.

Devolved government bodies have also been involved in a growing number of deals, driven by Scottish, Welsh and Northern Irish initiatives. This increase in activity is particularly noticeable since 2016, which coincides with the increased devolution of powers to the Scottish government.

Private Equity and Venture Capital

Backed 711 deals in 2018

Private Equity and Venture Capital firms are investment institutions that specialise in buying and growing the value of shares in private companies. Frequent investors of this type include the Business Growth Fund, Mercia Technologies and Parkwalk Advisors. There are important differences between private equity firms and venture capital firms, that largely pivot around the size and stage of the companies they invest in.

Private equity firms often invest in more established companies, providing larger chunks of investment. These ‘safer bets’ have often already demonstrated profitability, and may be closer to a market exit. They tend to invest in established sectors, with more traditional business models.

Alternatively, venture capital firms offer smaller packages of equity for high-potential seed and venture stage companies. A VC’s portfolio of start-up companies may have a low overall survival and success rate, but the losses are justified by the large profits made from one hugely successful investment. VC’s tend to invest in companies using pioneering new technologies, operating within emerging sectors.

Both types of firm raise funds from, and invest on behalf of, large pension funds and insurance companies, and/or groups of high value individuals. Both often offer mentoring and consultation services to their portfolio companies, catalysing their growth and valuation.

Crowdfunding

Backed 347 deals in 2018

Crowdfunding investments are made with the capital of many individual investors, facilitated through an online platform. Crowdcube, Seedrs and SyndicateRoom are amongst the most active crowdfunding platforms. Companies hold funding rounds through the crowdfunding website; the platform will often perform due diligence and select the companies they allow to fundraise through their site. They may also offer support and guidance to the company throughout their campaign. As individuals can choose which companies they want to invest in, it is often consumer-focused industries that have great success raising funds through crowdfunding. These individual investors will then be issued shares in the company, once the campaign is closed.

Angel Networks

Backed 155 deals in 2018

Angel networks allow high net worth individuals (HNWIs) to combine their capital to make a joint investment in a company, taking a larger overall share of the organisation. Frequently investing Angel Networks include 24Haymarket, Equity Gap and Archangels. They often invest in early stage companies, and can provide mentorship and guidance. This type of equity investment is often fuelled by the particular sectoral or personal interests of the angels, and individualised motivation means that angels can provide more patient capital than larger institutional investors. They also have more control over where and when they can make their investments, making this type of investment more sensitive to macro-economic uncertainty and changes in policy. This could explain why the number of angel network investments declines by 20% between 2017-2018, following prolonged uncertainty around the UK’s relationship with the EU.

Devolved and Central Government

Devolved government funds backed 155 deals in 2018

Central government funds backed 59 deals in 2018

Governmental initiatives to support young, growing businesses can include equity investment as well as grants and loans. Devolved government bodies are particularly frequent investors, with the funds managed by the Scottish Investment Bank, such as the Scottish Venture Fund, and the Development Bank of Wales making a critical number of deals in their respective regions. These investments will often be made with social impact and economic growth in mind, with a focus job creation and infrastructural development.

Central government initiatives can also have a regional focus, such as the Northern Powerhouse Investment Fund and the Midlands Engine Investment Fund.

Corporate funds

Backed 69 investments in 2018

Large, established companies want to stay ahead of their industry’s competition; an important part of a winning market strategy is to proactively innovate and/or support innovation. Large corporates such as Google, BP and Microsoft have set up venturing arms that invest in companies operating and pioneering new technology within their sectors of interest. These established organisations may go onto acquire these small ambitious firms or license their innovative IP in their own products and services.

Our recent blog post further investigated the US tech giants that have been fuelling the growth of the ambitious UK companies.

University funds

Backed 35 deals in 2018

In order to commercialise and apply the intellectual property developed by their scientists and academics, universities can support the founding of spinout companies, and their subsequent growth. The university, often through one of its associated enterprise funds, will provide the company with venture capital, acting as a key shareholder in the company from the start. Additionally, the company may continue to have access to the academic institution’s workspace facilities.

Next in the series...

Over the next two posts in this series, we will deep dive into the nature of the investments that each of these investor types are involved in, approaching this topic using both small scale and macro scale analysis. First, a more granular look at the average investee and deal profile of each fund type. Following this, we will build a larger-scale picture of the sectoral and geographical trends that can be extracted from the deal data of each investor type.