What are R&D tax credits and what are the latest stats?

| Hannah Skingle

Category: Uncategorized

What are R&D Tax Credits?

First introduced for UK SMEs in 2000 and for large companies later in 2002, R&D tax credits are a government scheme to incentivise businesses to invest more into their research and development functions. Through the scheme, profit making companies can reduce their tax bill whilst loss making companies can receive cash credit as a percentage of their R&D costs.

There are now three different avenues for relief, the Small or Medium-sized Enterprise (SME) Scheme; the Large Company Scheme; and Research and Development Expenditure Credits (RDEC). In all three of these cases, ‘research and development’ is defined as a science and technology project which forms a new process, product or service or advances an existing one. See the government’s guidance document for a full explanation of criteria for tax credits.

Given the broad range of projects that are covered by the scheme, many businesses that carry out the claiming process in-house may not realise the full extent of activities which can be included, therefore missing out on financial benefits. Innovation consultancy companies, such as Leyton and GrantTree, can provide support and assistance for companies who may not know how to navigate the application process, or are not aware of the full value they can claim.

What do the stats show?

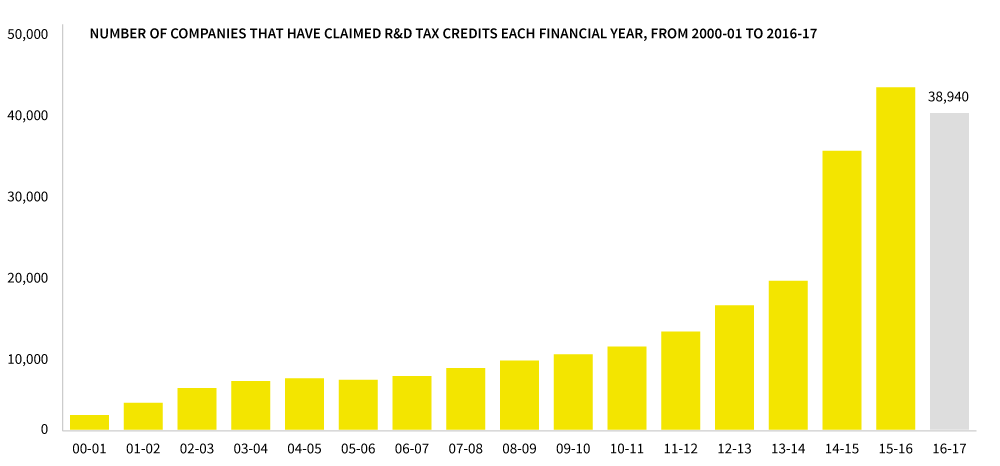

The latest government figures show that the number of companies claiming R&D tax credits has climbed steadily each year, with a fairly significant jump in 2014-2015. This steep increase is due to revisions made to the SME scheme, including the removal of the requirement for a minimum R&D expenditure of £10,000, plus an increase in the payable tax credit rate. Not only did this mean that more companies are eligible, but the scheme also became more attractive.

The figures for 2016-2017 are currently lower than the previous period due to a time lag on accounts being filed – it is likely that this figure will rise in the future.

* figures from HMRC report.

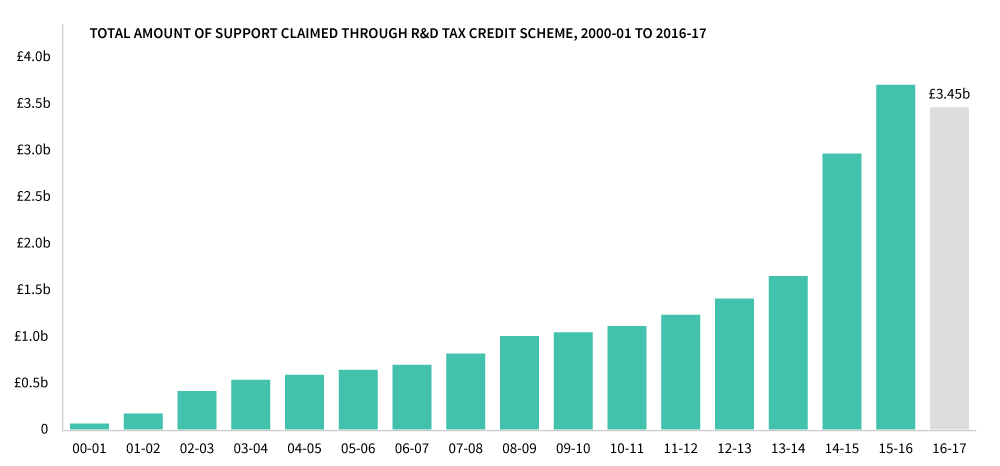

The total amount of support claimed through the scheme has naturally followed the same trend, with £3.45b worth of financial support offered to innovative companies in 2016-2017. Again, this figure will be affected by a time lag and is likely to increase in the future.

* figures from HMRC report.

Unfortunately, because this support for innovation is structured as a tax credit, the data about which companies receive it is not publicly available. Nonetheless, through this scheme the taxpayer is subsidising these businesses. We believe it should be possible to see which businesses are benefiting, so that it is easier to evaluate the success – or otherwise – of the schemes.

Henry Whorwood, Head of Research and Consultancy Tweet

In the meantime, the 32,000+ private innovative companies that we track is a fairly good place to start. We suspect that many of these companies are using the scheme, or are eligible but not yet using the scheme to its full extent, if at all.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.