Fintech shows no signs of stopping

| Beauhurst

Category: Uncategorized

This fintech story first appeared in The Deal, our annual review of equity investment activity in the UK.

It was widely predicted that 2017 would prove a stellar year for fintech, as new entrepreneurs sought ways to disrupt legacy aspects of the banking world whilst more established firms consolidated their position with fresh funding and new products. The predictions were right: in June, the top ten publicly-traded fintech businesses crossed the $100 billion market capitalisation mark for the first time. By the end of December, that figure had surged to $130 billion.

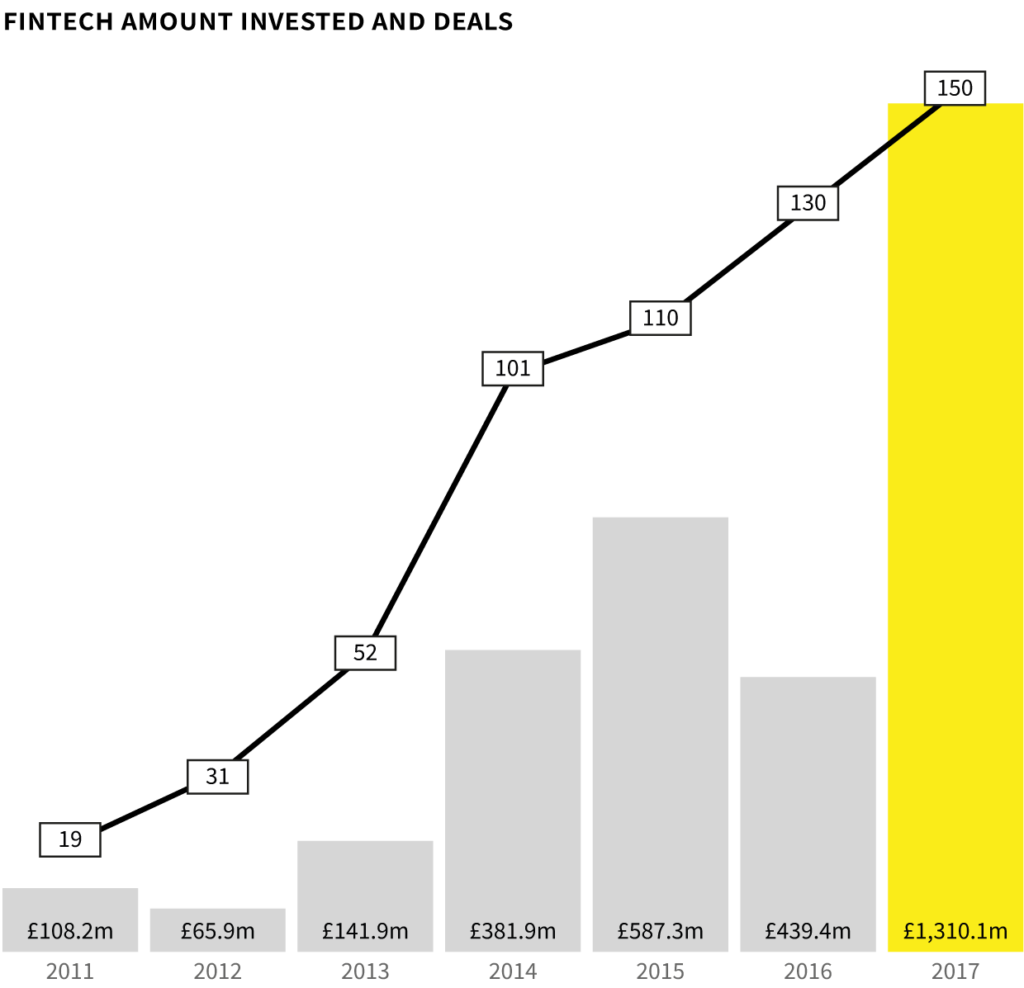

When it comes to unlisted firms, the numbers may be smaller – but the potential is huge. And the amount poured into the fintech scene topped £1.3 billion by the end of 2017; almost triple the £439m invested the year before.

A share of megadeals

This figure is buoyed by 2017’s increase in megadeals. Three challenger banks, Atom, Monzo and Revolut, each jostled for these, securing £113m, £71m and £51m respectively. 2017 also saw Monzo and Revolut launch their own current accounts, as they geared up to increase competition with traditional high street banks.

TransferWise, fast becoming a household name, clinched the fintech megadeal of the year, however, with $280m raised from a set of investment heavyweights including Old Mutual and Mitsui & Co. All in all, data shows that 2017 has been a bumper year for the fintech industry – and when compared with 2011, the amount of cash invested into UK fintech has soared by around 1100%.

It’s possible that Brexit and the possibility of a low-tax North Sea haven are making Britain more attractive to overseas investment, which seemed to drive many of 2017’s larger deals. It’s certainly true that the imminent split with the EU doesn’t seem to have dampened investor enthusiasm for UK fintech startups.

What’s next for fintech?

A lot of concerns regarding high-profile B2C fintech companies focus on how they will actually make money. TransferWise is, unsurprisingly, nearly in the black, with revenues more than doubling to £67m in 2017. With losses dropping from £17m to just £16k, they are on course for a considerable profit margin in 2018. Get your eWallets ready for a potential IPO.

Atom’s losses continue to slide, although its turnover has jumped considerably (from £46k in 2016 to over £1.1m in 2017). Monzo’s most recent financial statement shows an operating loss of £6.7m, but this is common for ambitious young startups investing heavily in their own growth, and it has several interesting avenues for generating turnover in the future. Revolut has published full accounts, revealing a healthy turnover increase.

Meanwhile, the hype surrounding cryptocurrencies in 2017 has translated into investor interest: announced equity investment rose from £512k in 2015 to £42m in 2017. We’ll have to wait and see if this outlasts bitcoin’s recent bust.

We look forward to tracking the UK’s fintech companies through 2018, and watching the extent to which they challenge our traditional financial institutions.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.